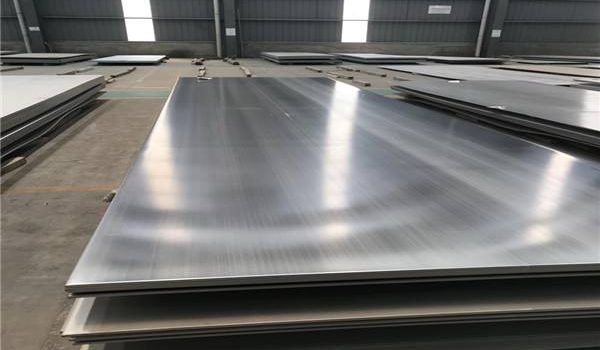

Hot Rolled Steel Sheet and Plate Characteristics

Hot rolled steel plate and sheet typically requires much less processing than cold rolled steel, which makes it a lot cheaper.

However, since hot rolled steel can cool at room temperature, it’s free from internal stresses that can arise from quenching or work-hardening processes.

HR steel sheet and plate can be identified by the following characteristics :

• A scaled surface—a remnant of cooling from extreme temperatures

• Slightly rounded edges and corners for bar and plate products (due to shrinkage and less precise finishing)

• Slight distortions, where cooling may result in slightly trapezoidal forms, as

opposed to perfectly squared angles

Our Steel division is a leading provider of hot rolled steel sheet and plate materials in numerous shapes and sizes that are based on your project’s exact specifications.

Payment & Transaction terms:

1. Buyer sends official LOI to GPG

2. GPG responds with official FCO

3. Buyer counter signs FCO for acceptance of the Conditions & Terms and send together with Company Certificate to Seller.

4. Seller issues Sales & purchase Agreement ( SPA ) open for amendment and review for buyer review together with Technical details of Commodity ( Annex A ) / Plan of total shipments delivery ( Annex B – Provided by Buyer ) Technical Specification signed and sealed (Annex C ) Commitment letter of Product Quantity & Quality Availability & Supply Commitment signed and sealed ( Annex D ) .

5. Buyer review (SPA), sign and returns a soft copy to the seller.

6. Seller final review (SPA) if any amendments necessary and issues Official Commercial Invoice and send both to buyer within 3 banking days final signed and sealed.

7. Buyer initiates the draft letter of 20%from the total contract value based on an MT700 LC at Sight , Confirmed, Revolving and irrevocable LC with full guarantee from the buyer’s bank for the total contract value for the seller’s bank to review and confirm.

8. Seller finalized the LC draft review and are ready to obtain the above said LC.

9. The buyer bank should record to activate the above said LC within 14 days after the issuing of the Commercial Invoice ( Step 6 above ) and release the Letter of Credit (LC) to the bank or financial institution for issuance by above said LC. Buyers bank issues the LC MT700 with a minimum total contract value coverage of 20% , MT700 Confirmed, Irrevocable, revolving LC to sellers financial bank.

( 20% of total MT Contract value x “MT unit price “ USD = ……………,- USD )

10. Seller issues a Performance Bond Guarantee of 20% of the total contract value as performance bond bank guarantee as PBG to the buyer’s account bank against the LC.

11. Seller within ten (10) business days comply and execute the processes of registering purchase order.

12. Shipment starts

IMPORTANT :

POP & Sight inspection will be submitted and exchanged ;

” Only and After an official MT700 Swift request from Buyer’s bank to our Seller’s bank has been send” .

Any additional documentation will only be exchanged through the secured Bank channels and only through MT700 or MT705 Swift enquiry – BCL /MT199 / MT799 or other similars as Proof of fund or as Swift exchange are not Accepted